Examples of supplies (office supplies) include pens, paper, andpencils. At the point they are used, they no longer have an economicvalue to the organization, and their cost is now an expense to thebusiness. This results in the movement of at least two accounts in the accounting equation. The amount of change in the left side is always equal to the amount of change in the right side, thus, keeping the accounting equation in balance. This transaction decreases assets when the cash is distributed and increases assets when the new equipment is received. Let’s take a look at a few example business transactions for a corporation to see how they affect its expanded equation.

Expanded Vs Traditional Accounting Equation

It is important to understand that when we talk about liabilities, we are not just talking about loans. Money collected for gift cards, subscriptions, or as advance deposits from customers could also be liabilities. Essentially, anything a company owes and has yet to pay within a period is considered a liability, such as salaries, utilities, and taxes. Equipment examples include desks, chairs, and computers; anything that has a long-term value to the company that is used in the office. Equipment is considered a long-term asset, meaning you can use it for more than one accounting period (a year for example). Equipment will lose value over time, in a process called depreciation.

Income Statement and Balance Sheet

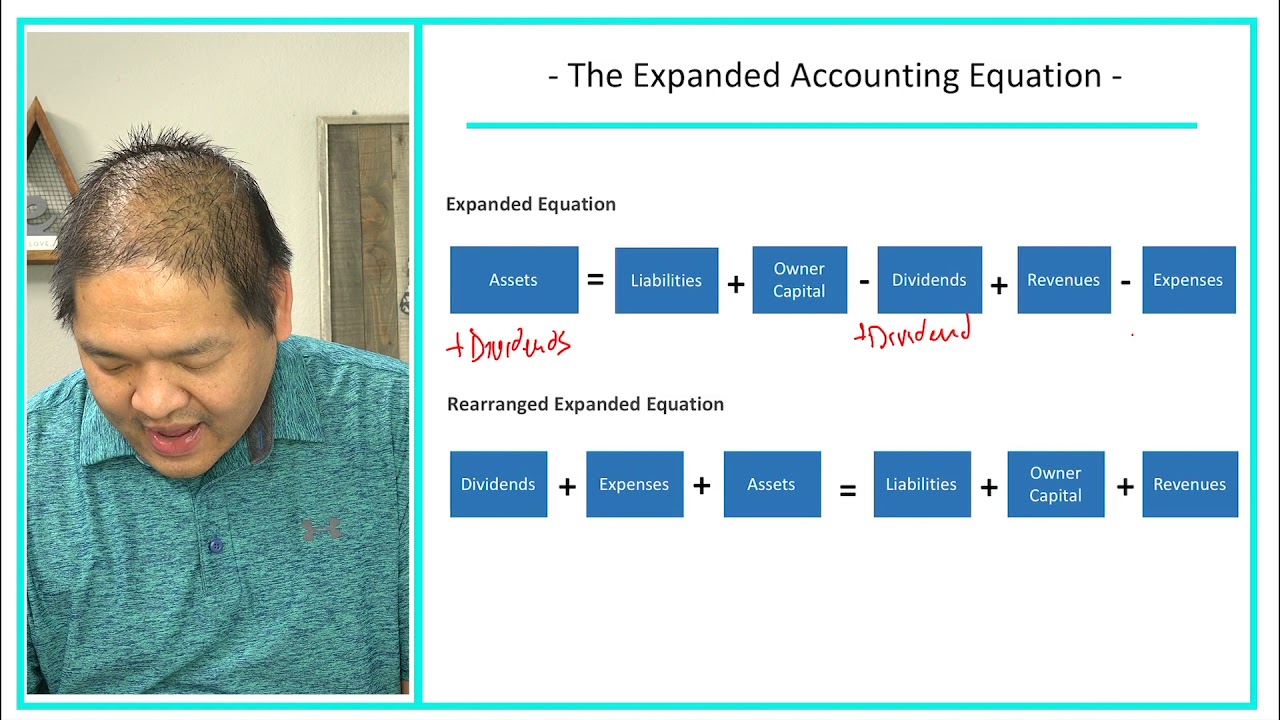

- The expanded accounting equation, on the other hand, presents an in-depth analysis of a company’s finances.

- A balanced equation also ensures that the whole accounting process has been followed properly.

- It will guide you in understanding related accounting principles and provides a foundation that will help you solve many accounting problems.

- Second, it can borrow the money from a lender such as a financial institution.

- Equipment is considered a long-term asset, meaning you can use it for more than one accounting period (a year for example).

The information in the chart of accounts is thefoundation of a well-organized accounting system. Essentially, the expanded accounting equation is derived from the basic accounting equation. This essential yet powerful tool will act as your compass, pointing you in the right direction when assessing your business’s financial health.

Owner Draws

Machinery is usually specific to a manufacturing business that has a factory producing goods. Machinery and buildings are often called PPE – Property Plant and Equipment. Unlike other long-term assets such as machinery, buildings, and equipment, land is not depreciated. The process to calculate the loss on land value could be very cumbersome, speculative, and unreliable; therefore, the treatment in accounting is for land to not be depreciated over time. Stockholder’s equity refers to the owner’s(stockholders) investments in the business and earnings.

The accounts may receive numbers using thesystem presented in Table 3.2. The expanded accounting equation also demonstrates the relationship between the balance sheet and the income statement by seeing how revenues and expenses flow through into the equity of the company. The dividend could be paid with cash or be a distribution of more company stock to current shareholders. An account is a contra account if its normal balance is opposite of the normal balance of the category to which it belongs.

We could also look to XOM’s income statement to identify the amount of revenues and dividends the company earned and paid out. An important thing to remember is that revenues increase equity while expenses and owner’s withdrawals decrease it. So, your regular income-related transactions involve these elements in addition to assets or liabilities. Gain better visibility into your profits and shareholder investments using this nifty tool.

Each of these categories, inturn, includes many individual accounts, all of which a companymaintains in its general ledger. As you can see with this example, the basic accounting equation remains balanced although we’ve split the stockholders’ equity into its components. The accounting equation emphasizes a basic idea in business; that is, businesses need assets in order to operate. There are two ways a business can finance the purchase of assets. First, it can sell shares of its stock to the public to raise money to purchase the assets, or it can use profits earned by the business to finance its activities.

The equation differs slightly in the case of a proprietary concern, partnership firm, and corporation. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

You will learn more about this topic in Chapter 3, and Accounting, Business and Society. An expanded accounting equation provides a detailed view of the financial statements and shows how effectively the accounting policies are in place. Further, from a professional point of view, it provides a glimpse of the organization’s tax relief for taxpayers affected by oregon wildfires financial well-being and net worth of the organization. It is an important concept from the accounting point of view because it provides a picture of the organization’s financial well-being. The accounting equation includes information from the balance sheet and provides information about the income-expenditure statement.

Equipment examples include desks, chairs, and computers;anything that has a long-term value to the company that is used inthe office. Equipment is considered a long-term asset, meaning youcan use it for more than one accounting period (a year forexample). Equipment will lose value over time, in a process calleddepreciation. Cash includes paper currency as well as coins, checks, bankaccounts, and money orders. Anything that can be quickly liquidatedinto cash is considered cash.

The expanded accounting equation operates on the principles of double-entry bookkeeping, where each financial transaction your business makes affects at least two accounts. Think of it as going through a buffet spread of your business operations, filled with assets, liabilities, revenues, expenses, and owner’s equity. Naturally, you may be drawn towards some aspects while being cautious about others. Liabilities are obligations to pay an amount owed to a lender (creditor) based on a past transaction.