On the other hand, company XYZ, a competitor of ABC in the same sector, had a total revenue of $8 billion at the end of the same fiscal year. Its total assets were $1 billion at the beginning of the year and $2 billion at the end. Since the total asset turnover consists of average assets and revenue, both of which cannot be negative, it is impossible for the total asset turnover to be negative. But even if your asset turnover ratio number isn’t where you want it to be, don’t worry—that number isn’t set in stone.

DuPont Analysis

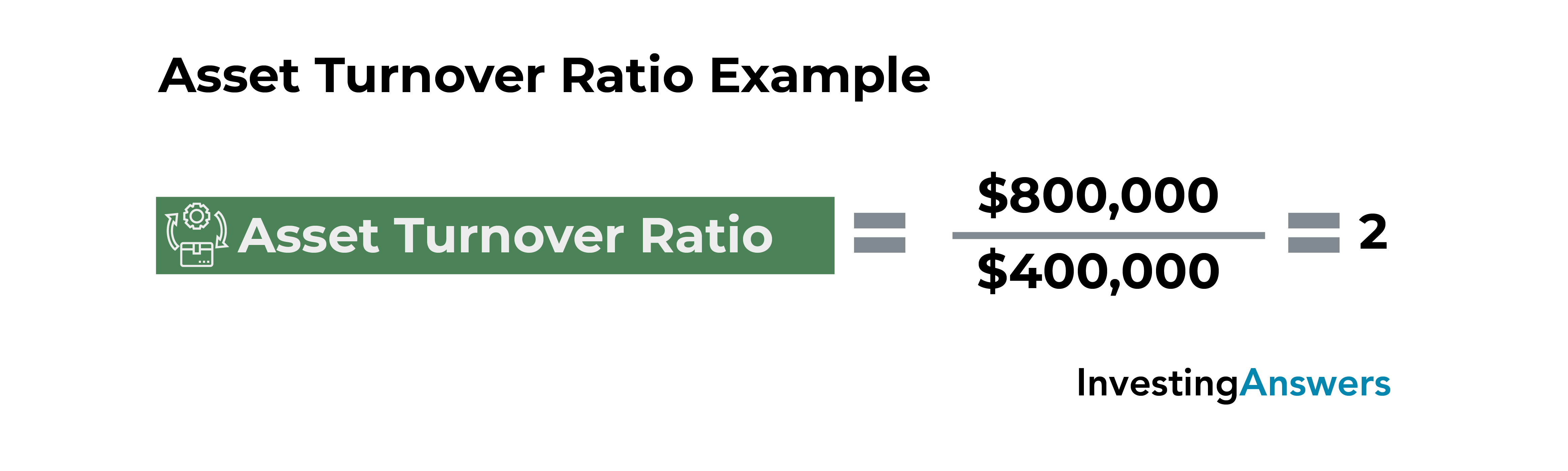

The asset turnover ratio considers the average total assets in the denominator, while the fixed asset turnover ratio looks at only fixed assets. The fixed asset turnover ratio (FAT ratio) is used by analysts to measure operating performance. The asset turnover ratio is defined as the amount of sales or revenues generated per dollar of assets. It is a financial metric that helps in assessing the efficiency of a company’s use of its assets to produce sales. The importance of this ratio lies in its ability to provide a snapshot of a company’s operational efficiency. A higher ratio indicates that the company is generating more revenue per dollar of assets, which is a sign of good management and a potentially profitable use of investments.

Step 1: Find your net sales.

This article will help you understand what is fixed asset turnover and how to calculate the FAT using the fixed asset turnover ratio formula. From the calculation done, it is interpreted that for every dollar in assets, Walmart generated $2.29 in sales, while Target generated $1.99. Compared to Walmart, Target’s asset turnover is low which could be an indication that the retail company was experiencing sluggish sales or holding difference between bond and loan obsolete inventory. In order to understand how to interpret asset turnover ratio, we will look at an example. We will calculate the asset turnover ratio for four companies in the telecommunication-utilities and retail sectors for FY 2020 and compare them. We will be using the financial statements of Walmart Inc. (WMT), Target Corporation (TGT), AT & T Inc. (T), and Verizon Communications Inc. (VZ) for this example.

Inventory

On the other hand, Telecommunications, Media & Technology (TMT) may have a low total asset turnover due to their high asset base. Thus, it is important to compare the total asset turnover against a company’s peers. Check out our debt to asset ratio calculator and fixed asset turnover ratio calculator to understand more on this topic.

How to calculate the fixed asset turnover — The fixed asset turnover ratio formula

- It also makes conceptual sense that there is a wider gap between the amount of sales and total assets compared to the amount of sales and a subset of assets.

- You don’t want to be judging yourself on a metric you set yourself—especially when it’s one that’s meant to help you improve your business.

- Average total assets are found by taking the average of the beginning and ending assets of the period being analyzed.

Other sectors like real estate often take long periods of time to convert inventory into revenue. Though real estate transactions may result in high profit margins, the industry-wide asset turnover ratio is low. A higher ratio is generally favored as there is the implication that the company is more efficient in generating sales or revenues. A lower ratio illustrates that a company may not be using its assets as efficiently. Asset turnover ratios vary throughout different sectors, so only the ratios of companies that are in the same sector should be compared.

While investors may use the asset turnover ratio to compare similar stocks, the metric does not provide all of the details that would be helpful for stock analysis. A company’s asset turnover ratio in any single year may differ substantially from previous or subsequent years. Investors should review the trend in the asset turnover ratio over time to determine whether asset usage is improving or deteriorating. This is because the fixed asset turnover is the ratio of the revenue and the average fixed asset. And since both of them cannot be negative, the fixed asset turnover can’t be negative.

The following article will help you understand what total asset turnover is and how to calculate it using the total asset turnover ratio formula. We will also show you some real-life examples to better help you to understand the concept. Your business’s asset turnover ratio indicates whether or not you’re efficiently managing—and optimizing—your assets to produce the highest volume of sales possible. You want to maximize your output with as little input as possible, so this is a crucial number to know. Asset turnover ratio is one of the most crucial business stats and accounting formulas to know.

Due to the varying nature of different industries, it is most valuable when compared across companies within the same sector. The asset turnover ratio is expressed as a rational number that may be a whole number or may include a decimal. By dividing the number of days in the year by the asset turnover ratio, an investor can determine how many days it takes for the company to convert all of its assets into revenue. The asset turnover ratio is a key component of DuPont analysis, a system that the DuPont Corporation began in the 1920s to evaluate performance across corporate divisions.

The asset turnover ratio stands as a critical gauge for investors and analysts aiming to understand the efficiency with which a company utilizes its assets to generate revenue. This metric offers insights into operational performance, revealing how effectively management is at deploying resources to support sales. For instance, in the retail industry, the businesses’ total assets are usually kept low and as a result, most businesses’ average ratio in the retail industry is usually over 2. If a company belongs to the retail industry and has an asset turnover of 1.5, for example, it is interpreted that the company is not doing well. Also, a high asset turnover ratio interpretation may not necessarily always mean efficiency. Management can attempt to make a company’s efficiency seem better on paper than it actually is by selling off assets.