Keeping a record of all transactions helps calculate the net profit and loss for the business. It is also useful during the calculation of profit or loss year on year or even during the quarter to quarter or as required by the company. The format of account sales shown in the above example is pretty much simple. We can divided an account sales into three sections on the basis of information it provides to the consignor.

How to prepare for a business sale

Sometimes though, the line between a midsize company and enterprise are thin or blurry; or, all the companies you deal with are generally the same size. So, it’s a good idea to build specific criteria that can help you decide if an account or opportunity needs a plan. You can divide your opportunities into “simple accounts” and “strategic accounts,” with the strategic group needing plans. Okay, now that we got that out of the way, let’s jump into how to actually do the thing and work on a successful account planning process.

Content

If a seller has an account or even accounts that are both competitive and have premium and exclusive items, they’ll be able to make even more profit, as they are hard to come by and therefore more expensive.

Contents

A due diligence is an in-depth assessment which a buyer conducts in order to ensure that the company´s status is as promised. Being prepared for the due diligence can make the difference between a smooth transaction and one which falls through at the last moment. In terms of liabilities, identifying financial debts and other commitments such as long-term contracts and possible litigation is essential.

As sale results in increase in the income and assets of the entity, assets must be debited whereas income must be credited. A sale also results in the reduction of inventory, however the accounting for inventory is kept separate from what is adjusted gross incomeing as will be further discussed in the inventory accounting section. Incomes generated through activities that are not part of the core business operations of the business are not classified as sale revenue but are classified instead as gains. For instance, sale revenue of a business whose main aim is to sell biscuits is income generated from selling biscuits. If the business sells one of its factory machines, income from the transaction would be classified as a gain rather than sale revenue.

This example showcases the importance of tracking and recording various sales transactions, as they provide insights into customer behavior, product performance, and overall business profitability. The Times was founded as the conservative New-York Daily Times in 1851, and came to national recognition in the 1870s with its aggressive coverage of corrupt politician William M. Tweed. Following the Panic of 1893, Chattanooga Times publisher Adolph Ochs gained a controlling interest in the company. In 1935, Ochs was succeeded by his son-in-law, Arthur Hays Sulzberger, who began a push into European news.

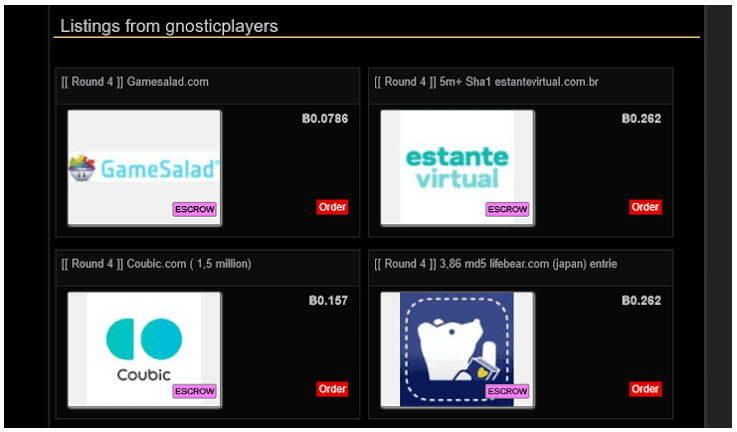

Finally, a firm may always establish individual escrow or trust accounts for specific matters or clients. Individual accounts should be interest-bearing, unless the funds will be held for only a short time or are likely to yield only a small amount of interest. If payment of interest to the recipient of the funds might present problems (a real possibility in certain situations), an individual IOLA account may be opened and the interest will be forwarded to the IOLA fund.

They put a lot of effort into finding out what sells well so that they can optimize their profit margins. Still, despite the danger, these web pages remain as go-to places for both buyers and sellers. In fact, many of them continue to be convenient and secure hubs for online gaming-related training. If you want to sell Steam accounts, then you’re in the right place (but after you compute for the value of Steam account).

There are many different types of sales account, each with their own strengths and weaknesses. The most common type of sales account is the individual account, which represents a single person or company. These accounts are often used by small businesses or self-employed individuals. It’s important for businesses to maintain accurate sales accounts as they play a crucial role in financial analysis, tax computation, and strategic decision-making. Almost everything’s online nowadays, or at least has a component that requires or improved by an internet connection, including video games. Aside from online games, gaming platforms and consoles now require you to have an account as well.

- It includes all sales and returns-related transactions which help a business determine the net sales for a given accounting period.

- That “record” must include the “date, source and description” of every deposit and the “date, payee and purpose” of every withdrawal.

- The records of the organization have to be studied in order to understand the potential benefits and the effects that it will have on the organization and its employees.

- As gaming became a popular and readily available hobby, earning money through it has become as easy and familiar as selling used games, in-game accounts, or even piloting services.

Having transparent transactions not only helps business but also helps the customers to form a trust over the organization regarding the ethics it follows. Sales account is defined as a record of all the transactions that are happening in the business, which include the sales carried out by credit as well as cash. This account is usually combined with the returns and allowances account, which will help to arrive at a figure which is called net sales. The consignee may have to pay some expenses in respect of the goods consigned to him. Examples of such expenses include, insurance expenses, unloading wages, marketing expenses and godown rent etc. As the consignee acts as an agent and pays all these expenses on behalf of the consignor, he is entitled for a reimbursement of such expenses.